On 21st November governments, international institutions, corporate actors and mainstream civil society groups will meet in Edinburgh for the first ‘World Forum on Natural Capital’.

Following the launch of the Natural Capital Declaration, promoted by major global banks at the occasion of the World Summit on Sustainable Development in Rio in June 2012, business and governments are working to assign monetary value to services provided by nature’s different services, under the banner of the so-called “Green Economy”.

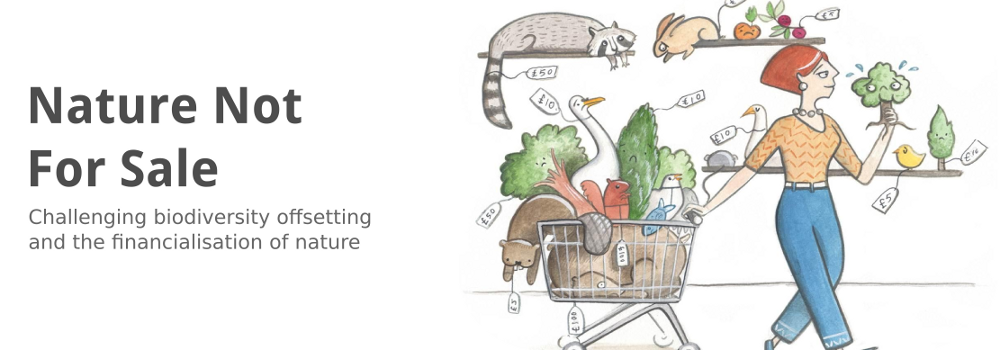

In an era dominated by global finance where trading money, risk and derivative products is more profitable than trading actual goods and services such a move comes as no surprise. Global finance requires the constant development of new assets: their next target, nature itself. This is what we call the financialisation of nature.

The first large scale implementation of this idea is the carbon market where carbon emissions are traded and as if it were financial commodities. Despite their profitability carbon markets have failed to addressing the climate crisis, succeeding only in generating huge profits to financial and corporate actors.

In order to enable the trading of nature and natural services an enormous amount of work is being done by consultancies, banks and governments to define what nature’s services are and how they can be commodified. That’s why the ‘World Forum on Natural Capital’ aims at giving a monetary value to all ecosystem services. The next step for banks and governments is to facilitate the trade in these services, as has already been done with carbon. This market is expected to be worth many trillions of dollars per year.

We believe nature’s value is priceless and has to be protected. That’s why we reject this new wave of commodification and financialisation of nature promoted by governments, corporations and banks. Putting a price on nature will not save it from pollution and destruction. To the contrary, these new commodities will only guarantee extra profits to the few, while leaving the environment at risk in the long-run.

Ecosystems and their services are common resources and must not be enclosed for private gain. Compliance with existing environmental regulation would be replaced with financial compensation. Instead of saying that a polluter does not have the right to pollute our common resources, markets sell that right. Once a price is put on nature, all of our common resources can be bought, sold and packaged. Worse, as we have seen in the recent financial crisis, a market can be manipulated, repackaged and resold as financial derivatives, bonds and other products.

Ultimately, accounting natural capital will result in increased exploitation of natural resources instead of protecting them. Join us in Edinburgh to stand up to global finance and share ideas to protect the commons for the benefit of all.

Berber Verpoest, Counter Balance

Antonio Tricarico, Re:Common